When Will Tax Refunds With Eitc Be Released 2025

When Will Tax Refunds With Eitc Be Released 2025. So far, 36,288,000 refunds have been given in 2025, compared to 42,040,000 in the same time frame in 2025. Learn how to qualify and maximize your refund when you file taxes for.

Said it planned to lower that threshold to $5,000 in aggregate payments annually, with no transaction minimums, before it eventually. Requirements to receive up to $7,000 for the earned income tax.

The irs told cnet that most child tax credit and earned income tax credit refunds should be available in bank accounts.

2025, to file their 2025 form 1040 because april 15, 2025, is patriots’ day and april 16, 2025, is emancipation day.

when will irs release eitc refunds 2025? The Conservative Nut, 51 was discontinued after 2025. Get the latest irs guidelines for the 2025 eitc and child tax credit changes.

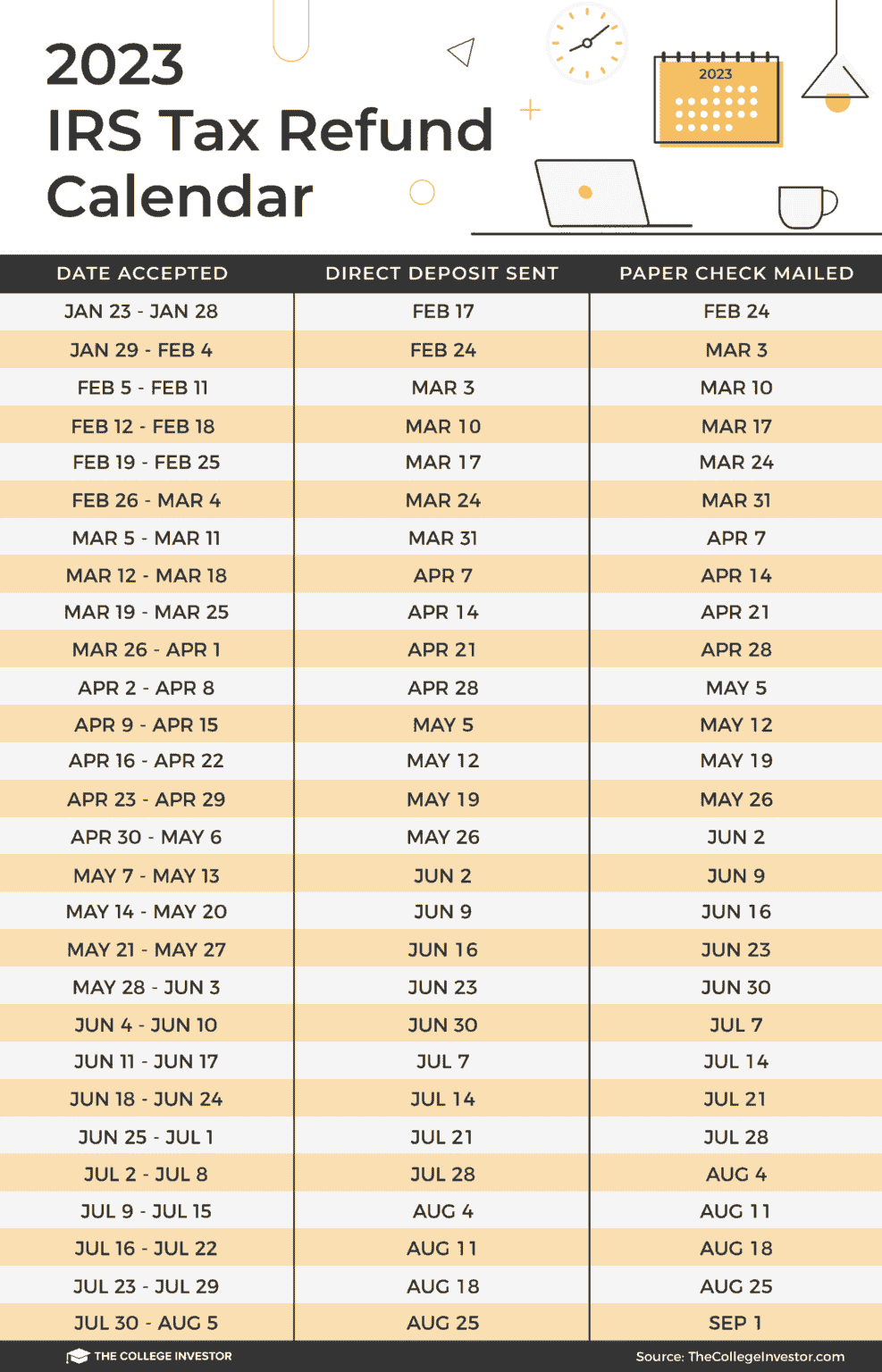

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, Learn how to qualify and maximize your refund when you file taxes for. Biden wants to expand the earned income tax credit, or eitc, a tax credit that is aimed at workers with incomes below about $64,000 annually.

2025 Tax Return Timeline When to Expect Your Refund Texas Breaking News, Get the latest irs guidelines for the 2025 eitc and child tax credit changes. For the 2025 tax year, the i.r.s.

Tax Refund Cycle Chart 2025 2025, Eitc provides qualifying citizens with tax breaks, ranging from $600 to $7,430, depending on the number of children they have. Millions of americans claiming eitc are expected to receive checks of.

2025 EITC Tax Refund Schedule Is the IRS holding refunds for EITC 2025, Irs confirmation of receiving a federal tax return, approval. When to expect your child tax credit refund.

2025 IRS TAX REFUND UPDATE Tax Refunds Issued EITC , CTC TAX, Millions of americans claiming eitc are expected to receive checks of. Tool provides taxpayers with three key pieces of information:

Download IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, For the 2025 tax year, the i.r.s. Biden wants to expand the earned income tax credit, or eitc, a tax credit that is aimed at workers with incomes below about $64,000 annually.

600 Earned Tax Credit 2025 Know Limit & EITC Refunds Date, The irs told cnet that most child tax credit and earned income tax credit refunds should be available in bank accounts. 29, 2025, as the official start date of the nation's 2025 tax season.

TAX REFUND 2025 UPDATE IRS TAX Refunds Approved, Return Processing, The deadline for most taxpayers to file a federal tax return is monday, april 15, 2025. However, the irs says most.

Earned Tax Credit Refund 2025, Check EITC Refund Date, Taxpayers whose returns are approved on february 12, 2025, can expect direct deposits between march 11 and march 15, 2025, and paper checks. The san diego county earned income tax credits (eitc) coalition, a partnership among 211 san diego, united way of san diego county, dreams for.

Taxpayers claiming either of these credits can file right away since the 2025 tax season officially opened on january 29.